CafeMutual.com has come up with a case study. While I am not eligible for applying but never less, I have decided to put my thoughts.

The scenario

45-year-old Preeti lost her husband Arjun due to covid. Arjun was the sole bread earner in the family and is survived by his wife, aging mother, and 12-year-old daughter.

Preeti will get Rs.2 crore from an insurance company and Rs.32 lakh from Arjun’s employer in the form of provident funds and gratuity.

Preeti knows that Arjun was investing in mutual funds through SIPs but she has no idea how to get this money. The current value of his MF holdings is Rs.17 lakh.

Now, Preeti approaches you to get help on mutual funds. She also wants to you devise a mutual fund investment plan to fund her daughter’s higher education in 6 years and wedding in 15 years.

Preeti also wants your help to generate regular income to meet household expenses which include the medical expenses of her mother-in-law. Currently, the family spends Rs.28,000 per month to meet monthly household expenses.

Preeti does not have term insurance and medical insurance. Also, Arjun had an outstanding house loan of Rs.33 lakh.

Abhishek’s Reply

Dear Preeti,

Life has taken a very very unfortunate turn for you and this is one step that is irreversible by the very nature of it. The pain of this event is bound to cause an immense amount of uncertainty, cripple the thought process, and sooner or later you will find the center of your life will rebalance itself to you and your daughter.

Arjun made very very prudent fiscal choices that will not only help you and your daughter to stand again on your feet but as well as secure your financial future from here on. However, it is important for you to understand that money if not handled well becomes a cause of stress instead of a reason for freedom. it is quite possible that knowing there is insurance money, you may find yourself tending to incessant calls from your relatives as well as banks trying to sell you plans which may not be suitable. I strongly recommend you approach a financial planner.

Here are a few assumptions and choices I am presenting to you.

Your knowledge about finances: given you are a homemaker and currently not aware of your husband’s investment, it seems your role wasn’t to understand finances. Also, you may not be aware of anything about a complex product which may be very risky in nature and your knowledge may be limited only to FDs of some banks.

I am assuming that Rs 17 Lakh lying in mutual funds are equally distributed between equity and debt funds at 50%: 50%.

I am also assuming that Rs 28000 per month expense is beyond your home loan EMI.

I am also assuming that your frame of mind right now is very muddled and insecure and you need a lot of hand holding.

Your Assets and Your Liabilities

Arjun made some brilliant financial choices that will ensure a very financially secure future from here on for you and your daughter. This is how your current financial balance sheet looks like. (Assuming all the money is available).

What is important for you and your daughter

The fiscally secure monthly expense

Graduation and wedding of daughter

Health expenses of your Mother -in-law

What is also important for you is to now reduce the number of decisions and simplify your choices so that you have a clear focus on rebuilding your life without any distractions. Let the insurance money and PF money sit in the bank account for a while so that you can streamline your decision-making. It is not important to optimize every rupee but it is very important to make the right choices. It also means that the first 3 steps that you will take are the following.

a. Buy Term insurance under your Name, the Nominee should be your daughter: Buy at least 2 crores worth of Life insurance. (Term Plan). This means that in any unfortunate situation, your daughter has access to funding to build her life. Expected expense per month for next 20 years: Rs 4000

b. Buy Health insurance for you and your daughter: At least 20 Lakh + Top-up plan and ensure it is without any Copay. try and buy a separate health policy as per conditions applicable for your mother in law too. Expected Expense per Month: 3000 Per month for you and your daughter

c. Pay off your home loan: While many people will suggest keeping the loan for the tax benefit, however, I will recommend reducing your loan to 0 so that there is no tension on your mind ever, as well as the papers, are with you and your daughter completely. while there is a definitive benefit in keeping the loan in terms of some monetary gain but given your situation, I will strongly recommend you not to carry the loan.

These 3 activities should take a month for you to finish off and should help you prepare for your financial journey from here on.

So your new balance sheet looks like after paying the home loan and assuming everything as constant till December 2021 and assuming some 1-2 lakh rs expense in settling up.

Assets: Rs. 2.13 Crore and 0 Liability

Your Goals

Goal 1, Regular Expense: While you have mentioned that your expenses are averaging at 28000 per month. I have added Rs 3000 for insurance and Rs 3000 for Health insurance per month and a buffer of 6000 per month. We at times underestimate the expenses so it is always prudent to take a buffer and plan with a buffer in hand.

Goal 2 and 3 are related to Education and Wedding and I have assumed that you would want to provide some reasonable skill-based education to your child which can be easily afforded as well. I have also added a few lakh rs for 4 years of education which your daughter will need for her personal expenditure like a hostel, food, and travel in case she goes to a different city.

We will take absolutely No risk for this goal because it is just 6 years away

For a Wedding, I have assumed a nominal wedding today may cost Rs 20 lakh and in 15 years at 6% inflation, you might be spending about Rs 50 lakh on her wedding. This is the goal, I will put on least priority and in fact, focus more on child education and her professional life. Nonetheless, we will plan for the Goal.

We will take some risk for this goal via equity investment. Refer to table below

This is how your available money will look like once you have invested/saved/ earmarked money for various Goals. You are left with Rs 1.67 Crore to provide you a monthly income of Rs 40,000 for your various expenses for at least the Next 35 years.

Life Assumed: 80

We will divide the expense into 4 buckets of 10 years each so that we can minimize the risk for you and yet ensure that we reach the goal.

Phase 1 (Age 45 to 54), 10 years

we will not take any risk. Put your money in FDs/ liquid funds etc. We have to Ensure that there is constant Supply of money available for next 10 years with out any risk given your daughter education as well as rebuilding life is most important milestone for next 10 years. Any money earmarked for this duration should be free of any risk.

Given your tax slab, there will not be any tax to be paid for next 10 years as your interest income will not exceed 3 Lakh Rs per Year.

At the end of 10 years, there will be hardly any money left in this bucket but all your expense will be met.

Phase 2: Age 55 to Age 64

While your health expense may go up whereas your child's expense will come down significantly given her school education (Age 51) as well as college education (Age 54) will be finished by then and she may as well be earning/ being independent. However, we have not made any reduction in the overall expenses.

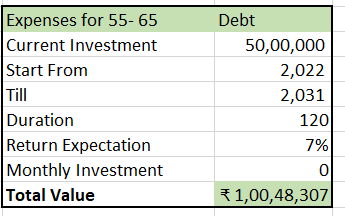

Assuming again that we will not take any risk for the next 10 years of expense when Age 55 arrives, however, we will invest in a conservative HYBRID fund for the first 10 years (Age 45 to 55) to fund expenses for Age 55 to 65. refer to the calculation below.

We will put 50 lakh Rs in a Debt fund with some allocation towards equity with an expectation of earning 7% over the next 10 years.

Here is how we will take care of the expense. As you can see that once the goal is achieved to allocate 1 Crore Rs for 10 years, we will expect just 5% from the corpus.

We are following a conservative approach for the second decade of your life from here on and it is prudent to be on the much safer side as compared to risk anything unnecessarily. There is a scope of having higher than an average expense that is built in this calculation. We will ignore the leftover amount for the sake of calculations.

There will be minuscule tax adjustments that will have to be done and we are ignoring that adjustment at this moment.

So you have already Allocated 55 Lakh Rs for the First 10 year expenses and 50 Lakh Rs for the Next 10 years’ expenses by 2022.

You will be left with Rs 1.67 Crore - 1.05 Crore = 62 Lakh rs as the remaining Corpus.

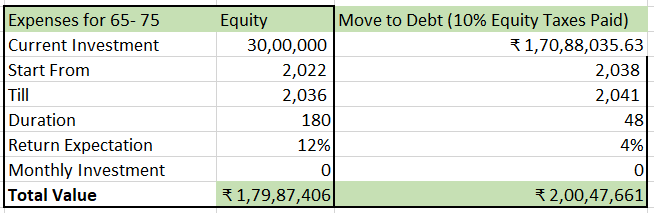

While it is not prudent to invest all 62 lakh Rs in one go in equity, but, for sake of simple calculations, let’s assume that you divide this 62 lakh Rs for two further goals of decade age 65-75 and decade 75-85.

Decade 65-75

We expect the equity Mutual fund to give us 12% returns over the next 15 years of investment. Assuming we shift towards a less risky option 5 years before the goal completion, this is how your calculation will look like. We have assumed to pay 10% capital gain taxes on movement from Equity to Debt.

This is how your expense will look like (including some extra buffer), ignore the leftover amount for sake of calculations.

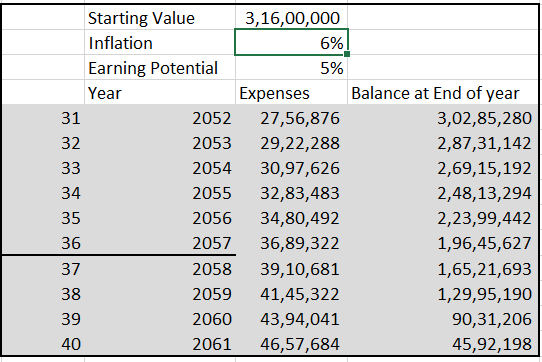

Last Decade: 75-85

We expect the equity Mutual fund to give us 12% returns over the next 20-21 years of investment. Assuming we shift towards a less risky option 9-10 years before the goal completion, this is how your calculation will look like. We have assumed to pay 10% capital gain taxes on movement from Equity to Debt.

this is how your expense will look like

Allocation of your Money as of 2022

Summary and some concluding remark

The Broader calculation here is to show you that all your goals are easily achievable and will provide a comfortable financial life to you and your family.

By doing better tax optimization, you will be able to further save some extra money, however, for sake of calculations and given how expenses are structured, your income will never cross the threshold value of taxation.

By safe investments, we mean low duration debt funds/ Fd/ Liquid fund in calculations. There are further few good options in PPF, NPS, and Sukanya samardhi scheme and we will delve into these options slightly later in your financial planning when we have to do the tax optimization.